WHY RUBBER CONTINUOUSLY DECREASING PRICES

As of August 26, the price of TSR20 rubber for the September term on SICOM traded around 143 cents/kg, equivalent to a decrease of 23.9% since the peak on January 19.

RUBBER PRICE TODAY 11/01/2021: THE PRICE IS INCREASING

EXPORTED RUBBER VOLUME INCREASES BY 2.8%, IMPORTS UP TO 45%

RUBBER PRICE IN THE ASIAN MARKET KEEPS RISING

THAILAND’S AMBITION TO ACQUIRE VIETNAM PLASTIC INDUSTRY

WHY RUBBER CONTINUOUSLY DECREASING PRICES

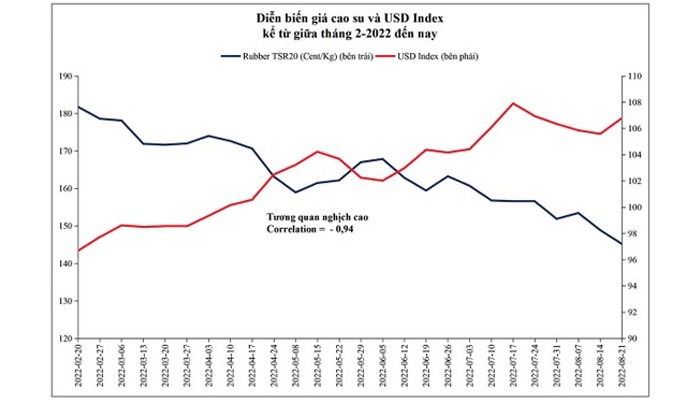

As of August 26, the price of TSR20 rubber for the September term on SICOM traded around 143 cents/kg, equivalent to a decrease of 23.9% since the peak on January 19. Shanghai and OSE (Japan) have also witnessed a continuous downtrend so far, with a decrease of 17.5% and 23.4%, respectively.

The reason for the continuous price reduction

The supply of natural rubber is not disrupted by the Russia-Ukraine war because it is mainly concentrated in Southeast Asian countries such as Thailand, Indonesia, Vietnam, and Malaysia, with an estimated share in 2022, respectively 34%, 22%, 9%, and 3% of the world. According to Sri Trang's report, the world's natural rubber output this year is expected to reach 14.27 million tons, up 3.5% from last year's output of 13.79 million tons. The output of most of the countries in the top 10 is expected to grow well, such as Thailand up 3.1%, Indonesia up 4.6%, Vietnam up 1.5%, and China up 6,8%.

With favorable supply, rubber prices were negatively impacted by interrupted or weakened demand, along with other pricing factors such as USD Index and crude oil. China's consumption demand accounts for 41% of the world's natural rubber market, but its economy continuously faces direct and indirect obstacles, such as the real estate market facing risks. default, blockade most of the time in the second quarter by the epidemic. In particular, the appreciation of the USD against the yuan and THB (Thai baht) has promoted the downtrend of natural rubber prices, because Thai exporters (accounting for 34% of the supply) have more room. to reduce prices to compete with market share. In the context of weakening purchasing power from Chinese importers due to economic stagnation and yuan devaluation.

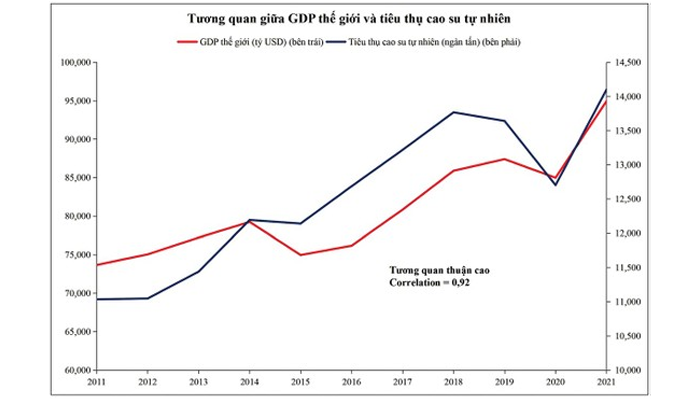

The price of crude oil has started to decline since the beginning of June, which has also contributed to the impact on the price of natural rubber. The measured positive correlation between WTI oil prices and natural rubber from 2010 to 2021 is 0.84. This is understood because the competition with synthetic rubber made from crude oil accounts for more than 50% of the raw rubber market. Not only weak demand in China, the US economy also witnessed negative growth for 2 consecutive quarters. With weak growth momentum from the world's two largest economies, forecasters have continuously revised down global GDP growth this year. And the demand for natural rubber has a high positive correlation with GDP, shown by the correlation coefficient = 0.92.

The driving force for the price increases comes from the auto industry?

Used tires account for more than 45% of the world's natural rubber consumption. Therefore, it is necessary to observe the growth movement from the auto industry. The China Automobile Industry Association in July cut its auto sales growth forecast to 3%, from the 5.4% previously forecast. The number of cars is expected to sell 27 million units this year, an increase of about 3% compared to 2021. Positive signals for the Chinese auto market began in June when it recorded 2 consecutive months of strong growth. The number of cars sold in June and July was 2.5 and 2.44 million, respectively, up 24% and 30% over the same period in 2021.

Thus, the Chinese auto market is expected to grow stronger, making up for the period of lockdown due to the epidemic in the second quarter. Demand will gradually increase in the last months of the year due to the strong cyclical characteristics of China's GDP in the fourth quarter. The prosperity of the auto industry also took place in many countries such as India, Vietnam, and the Philippines, with the number of cars sold increasing by 51%, 34%, and 27% respectively over the same period last year.

However, the auto industry in the US and the EU region shows the opposite. In June, the EU recorded the lowest number of cars sold since 1996, with just over 1.06 million units. It was the 12th consecutive month of declining car sales due to the economic slowdown caused by Covid and the prolonged semiconductor chip crisis. The cumulative number of cars sold in the US in the first 7 months of 2022 also recorded a marked decrease compared to 2021. Thus, it can be seen that the expectation of demand recovery from the auto industry is very precarious because the EU economy is expected to continue to be negatively affected by excessively high energy prices, in the context of the European Central Bank (ECB) has just started the roadmap to raise interest rates in July. The biggest hope is that China can return to normal economic activities because the country's auto demand can offset the total demand of the US and EU. At that time, the overall demand growth of the auto industry will depend on the remaining countries.

The US Federal Reserve (Fed) still sends a message that it is ready to act more aggressively to pull demand close to supply, to prevent inflation from getting out of control. This creates bullish momentum for the USD to continue for a while. This is an indirect factor that is detrimental to the price of natural rubber because it weakens the chance of the US economy to grow again in the near future. With the current developments, the chance of price increase for natural rubber is very low, the downward trend will continue at least until the Fed completes its interest rate hike.

>> Click HERE for the best paint chemicals on the market<<

Contact

MEGA VIETNAM

Office address: Floor 2-A2-IA20, Nam Thang Long Urban Area, Pham Van Dong Street,

Dong Ngac Ward, Bac Tu Liem District, Hanoi City, Vietnam

Email: contact@megavietnam.vn

Tel: (+84) 24 375 89089; Fax: (+84) 24 375 89 098

Website: megavietnam.vn

Hotline: 1800.577.728 Zalo: 0971.023.523